A property is let for. Stamp duty is the governments charge levied on different property transactions.

What Are All The Agreements That Need Stamp Duty

Only applicable for cases with.

. A tenancy agreement with 2 copies was signed on 4 January 2020 for a term of 2 years with monthly rental of 7000. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. To make things easier let us calculate your stamp duty for you with our tenancy agreement stamp duty calculator.

The SDLT threshold was raised in March 2005 to 120000 and in March 2006 to 125000. 6100 x 36 months 219600. The amount of stamp duty is 425 ie.

1000000 x 363 x 05 5 605. Visit a Physical Location to Get your Tenancy Agreement Stamped. To use this calculator.

Our Story Get to know us better. Our Guided Questionnaire Will Help You Personalize Your Legal Form in Minutes. Customize Your Tenancy Agreement Stamp Duty Today.

Our Vision Mission What. Buyers Stamp Duty BSD is a tax levied on property buyers when they purchase any property in Singapore. 7000 x 12 x 05100 5.

The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. Identity details for and landlord. It is required to be stamped within 30 days of the date of tenancy agreement execution or the landlord may risk.

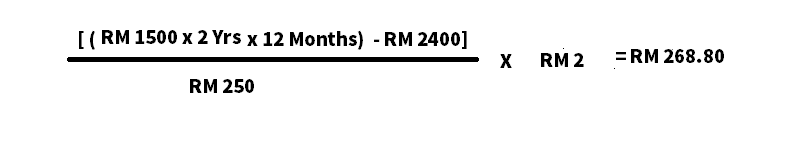

878 rounded down to the nearest dollar iii A lease with fixed rental and an additional rental. Tax Deducted at source TDS on Rent is applicable us 194 i of Income Tax Act 1961 w. The stamp duty for a tenancy agreement in Malaysia is calculated as the.

On a property purchased for 250000 the total stamp duty payable would be 2500. Be ready with Singpass 2-step verification 2FA to log in to e-Stamping Portal. Stamp Duty is a tax on Tenancy Agreement imposed by LHDN Malaysia.

Non payment or delay in payment of Stamp Duty attracts penalty Therefore it is mandatory to pay Stamp Duty. Or you can use Tenancy Agreement Stamp Duty Calculator Malaysia to Calculate. Sale Purchase of Property Sellers Stamp.

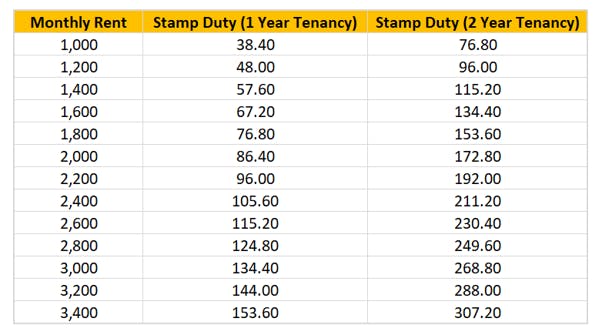

Stamp duty on rental units are taxes on tenancy agreement documents. Fill in your monthly rental and lease period of the property in. But how much will you have to pay for the stamping fee.

The stamp duty for a tenancy agreement in Malaysia is. Stamp duty is a tax which is levied by government on all property transactions. Tenants are required to pay this tax as long as they are renting whether its a room or an entire unit.

Pay Sellers Stamp Duty or claim for Sellers Stamp Duty Remission for Housing Developers for agreements relating to disposal of properties. Documents Needed to Pay Stamp Duty. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

A property is let for 10000 per month and the term of the tenancy is 3 years without a rent-free period. Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. In order for the tenancy agreement to prove effective during tenure you must get it stamped at LHDN.

04 x 219600 87840. Tenancy Agreement Stamp Duty Calculator. Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental.

1 st June 2017 If an individuals and HUF who pay rent per month of 50000 or. SDLT is a tax levied on tenancy transactions paid by Tenants and is calculated on the amount of. I lease term exceeding 1 year.

Our Values Principles we live by. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement. Iii no rent-free period.

The stamp duty payable is. Total Rent paid. If you perform e-Stamping frequently you may wish to sign up as a.

Admin Fee Amount RM1000. The amount of BSD to be paid is based on the purchase price or market value of the. Enter the monthly rental duration number of additional copies to be stamped.

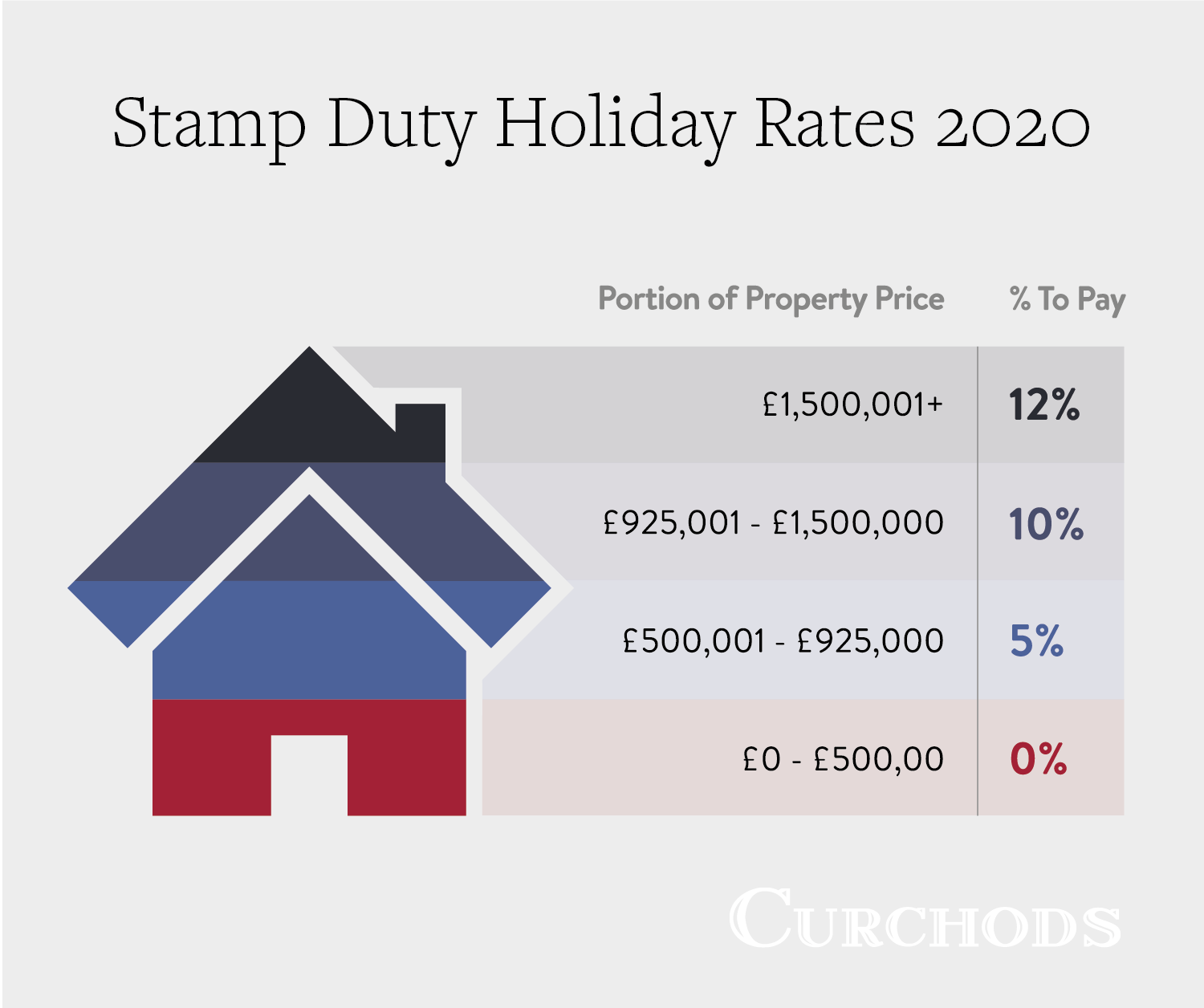

The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. From 1st October 2021 the initial stamp duty threshold is 125000. Based on the table below this means that for.

Ii fixed monthly rent throughout the whole period. Rental Stamp Duty Calculator helps you determine the amount of stamp duty payable to IRAS for the tenancy. Rental Stamp Duty Calculator - amount payable for rental property in Singapore.

Gift Deed Drafting Registration Stamp Duty Tax Implication Faq

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

What Is Stamp Duty In Hong Kong And How Much Is It Zegal

Ws Genesis E Stamping Services

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Property Stamp Duty Stamp Duty Calculation Stamp Duty Payment

Coronavirus Stamp Duty Holiday What It Means For Buyers And Sellers Curchods Estate Agents

Stamp Duty And Registration Charges In Tamil Nadu

Stamp Duty Exemption And Registration Charges On Property

Stamp Duty And Registration Charges In Kerala Kalyan Developers Blog

Online Stamp Duty Calculator Check Latest Rates Here

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

The Buyer S Stamp Duty Singapore An Essential Guide

Rental Agreement In Mangalore Rental Agreement Templates Agreement Rental

Ws Genesis E Stamping Services

Tenancy Agreement Stamp Duty Calculator Malaysia

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Ec Realty

Everything You Need To Know Before Signing A Tenancy Agreement Instahome